Financial Technology companies are constantly walking a line of compliance, security, and attractiveness to ensure customers have the utmost confidence in their brand. FinTech marketers are a special breed responsible for campaigns involving social media, commercials, content, which funnels down to the company’s website and applications.

For FinTech, it’s as important to design an effective website that converts as it is to select the right technology that powers your marketing efforts. FinTechs need technology that is at the intersection of ease of use, agility, and security.

In this article:

- What Exactly is a Content Management System (CMS)?

- What an Updated Website Can Accomplish for FinTech Brands

- Types of CMS Available to FinTech

- What Are the Benefits of a Headless CMS for FinTech?

- CMS Checklist for the Finance Industry

- Is Zesty.io the Right CMS for You?

- Advantages of Zesty.io for FinTech

- Is Migrating to Zesty.io Difficult?

So, what exactly is a content management system?

A content management system (CMS) is the platform that powers your website and content. Every CMS is different. At its core, a CMS is a software platform that lets its users create, edit, archive, collaborate, report, publish, distribute and inform. Traditionally, CMS's have been used to manage content on websites.

A CMS that still is used primarily to build and power websites, such as WordPress or Drupal, is considered a legacy system. The CMS market has developed significantly in the past 5-10 years.

Now, CMS's are much more powerful and can be used to manage content on websites, applications, advertisements, smart devices, and more. This is a powerful tool for modern marketing teams who have increased responsibility to produce and manage content in loads of other places than just the website.

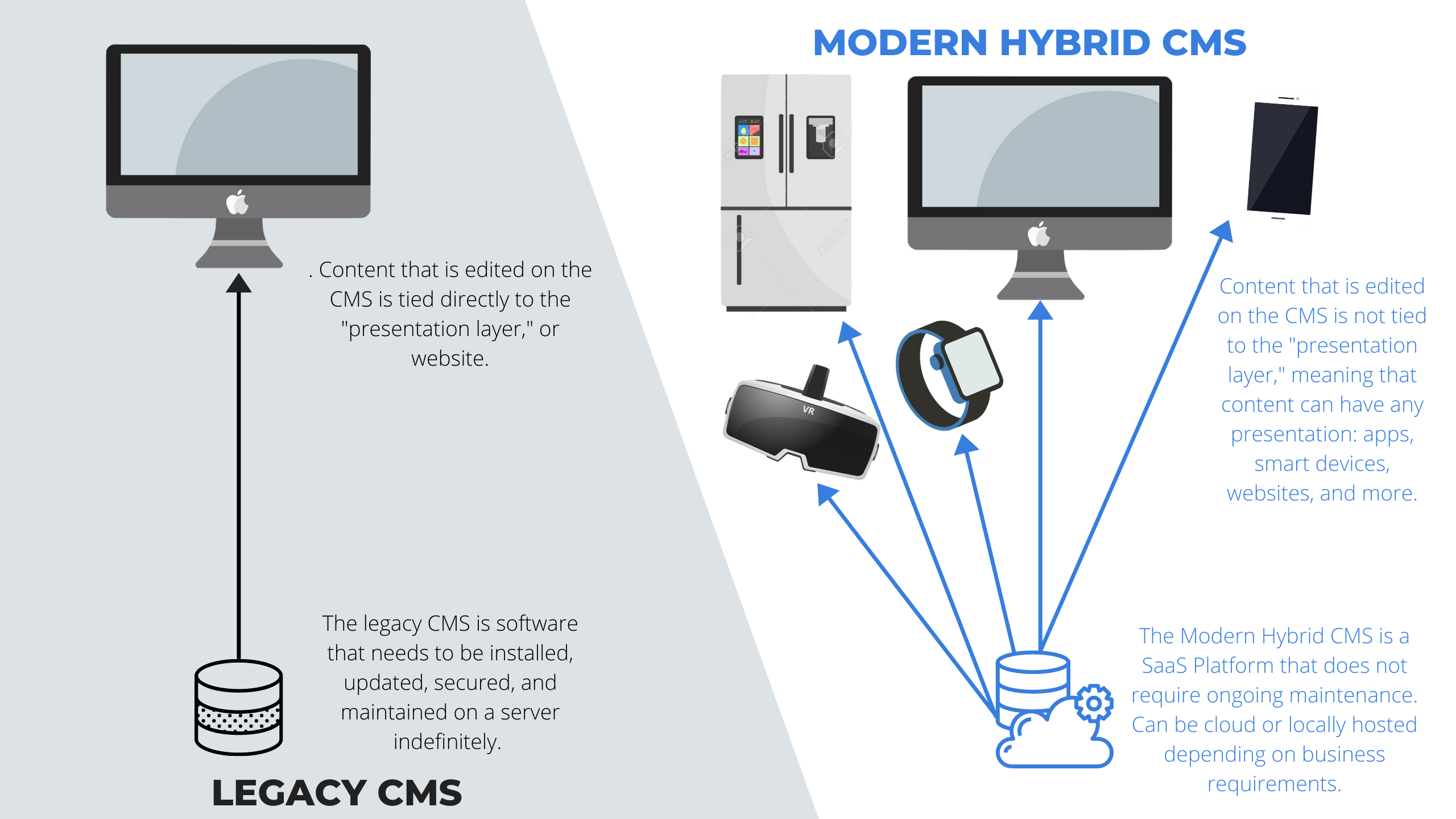

A legacy CMS can be summed up as software to manage content that needs to be installed, updated, secured, and maintained indefinitely on a server. The content the software manages is tied directly to the “presentation layer,” or the website/template.

A modern hybrid CMS is a SaaS platform that does not require ongoing maintenance and can be hosted on-premise or cloud, depending on the business requirements. Content that is edited on the modern CMS is not tied to a “presentation layer;” rather, this content can be pushed to any presentation, such as web or mobile applications, smart devices, websites, and more.

What an Updated Website Can Accomplish for FinTech Brands

Maybe your website is awesome, but you can’t launch campaigns quickly. Making sure your website checks these off your list (or revamping to make sure you hit these key points) will be key in driving more traffic and increasing conversions:

Rank High. SEO is key to FinTech companies. In a landscape with loads of competition, rating high is paramount. A site with excellent SEO will not only be properly indexed by Google, it will rank higher to increase opportunity to be found when prospects are searching for products like yours online. The technology that lies underneath the site is more important to SEO than many think. Read this article to learn how we redesigned our website and actually increased our SEO rankings.

Target Your Micro-Markets. It’s important to produce content on the site that speaks to your target demographics and niches. Whether that is by physical location, unique products, or both, your technology should be allowing you to easily create content specific to your markets around those topics.

Build Credibility. Sites need to be fast and accessible because prospects expect their information to be accessible anytime, anywhere. Make sure that your website is not only speed optimized, but also highly available wherever you serve content. This instills confidence in prospects that your business is trustworthy and reliable, a top consideration when looking to use a FinTech to maximize their money.

Increase Security. A secure website is paramount to avoid mistakes made by giant financial services companies. Ensure the security of your customer’s data, especially during an age where regulations like CCPA and GDPR are growing. Your vendors must also be compliant with those regulations in order for your business to meet or exceed your security requirements.

Types of CMS Available to FinTech

- Legacy

A legacy CMS can be summed up as a software to manage content that needs to be installed, updated, secured, and maintained indefinitely on a server. The content the software manages is tied directly to the “presentation layer,” or the website/template.

These are referred to as “legacy” because in most cases, there are other systems that are a better fit for business. Legacy CMSes don’t provide marketing agility, allow teams to manage multiple content destinations, and ultimately are just a way to build a static site. Many legacy CMSes also perpetuate dependencies on the development team, rather than allowing marketers to make and push changes as needed.

- Headless

A headless CMS is a CMS that separates the content from the presentation layer. In many ways, this is great because it allows for content to be distributed to a website, application, multiple websites, and more.

However, there are some downsides to a headless CMS in practice: because it’s a developer tool, there are many headless CMSes that don’t have a suite of tools for marketers, like previewing content or SEO tools, which puts businesses who rely on a headless CMS at a disadvantage because they still have to rely on development teams to make and publish changes.

- Hybrid

A modern hybrid CMS is a SaaS platform that does not require ongoing maintenance and can be hosted on premise or cloud, depending on the business requirements. Content that is edited on the modern CMS is not tied to a “presentation layer;” rather, this content can be pushed to any presentation, such as web or mobile applications, smart devices, websites, and more.

Typically, this is the best fit for businesses such as those in the Finance industry. These CMSes provide all of the development flexibility such as APIs and endpoints, while also providing marketing tools such as SEO insights and a friendly interface to make changes that automatically push to their destinations without relying on development teams.

What Are the Benefits of a Headless CMS for FinTech?

There are several benefits to choosing a headless or hybrid CMS for financial services. Mainly, these softwares are going to provide you a number of increased efficiencies over legacy CMS:

Software management. A headless or hybrid CMS can be a SaaS product. A SaaS (software as a service) product will generally decrease overall costs and headache. SaaS platforms handle the software hosting, availability, security, and updates, so you (and your development team) don’t have to.

Developer dependency. A headless or hybrid CMS can increase or decrease developer productivity. We generally recommend you choose a system that decreases developer dependencies so that they can focus on building the product rather than building and maintaining endpoints and websites for the marketing team. This allows better division of responsibilities so they can focus on what they need to do, and the marketing team is empowered to do what they need to do: create and publish content.

Marketing agility. A headless or hybrid CMS is in most cases going to facilitate marketing agility. These tools make it easier to create landing pages, build campaigns, and send content to multiple destinations so that teams can coordinate their omnichannel marketing efforts better and see increased traffic and conversions.

Increased SEO. Hybrid CMSes have much more to offer than a headless CMS in terms of SEO - in fact, purely headless CMSes can be detrimental to SEO. A hybrid CMS can increase content efficiency and delivery so that search engines rank pages higher.

Easier omnichannel marketing management. Both tools will facilitate omnichannel marketing management. Teams that have multiple websites, iOS and Android apps, web applications, smartwatch applications, have a lot of content to manage. Having a single source of truth rather than managing content in several platforms drastically increases both developer and marketing teams’ efficiency.

Cost savings. This depends more on the system and the use case, but generally speaking a hybrid CMS is going to offer more cost savings than a headless CMS. A headless CMS may increase costs because there may be maintenance costs associated with the software, as well as increased developer time and resources to get the most out of the software. A hybrid CMS manages the software and provides marketing teams and businesses agility, requires less development resources, and provides the best of both worlds, all in one platform.

Increased Security. A secure platform is paramount to avoiding mistakes made by giant financial services companies. Ensuring the security of your customer’s data, especially during an age where regulations like CCPA and GDPR are growing, is important. Your vendors must also be compliant with those regulations in order for your business to meet or exceed your security requirements.

Which is right for you: headless or hybrid?

To find out if a headless or hybrid (decoupled) CMS is right for you, check out our extensive guide on headless vs hybrid CMS.

| Question | Is it in Headless? | Is it in Hybrid? |

| Do you need to push content to various devices and platforms? | ✅ | ✅ |

| Do you have a workflow where you’re looking to decrease developer dependencies? | ❌ | ✅ |

| Are you looking to increase development efficiency so new campaigns can be launched sooner? | ✅ | ✅ |

| Are you looking for automated content delivery, scalability, and provisioning? | ❌ | ✅ |

| Do you need to preview content before it gets pushed to a website? | ❌ | ✅ |

| Do you want to increase the security of your platform and overall marketing websites? | ✅ | ✅ |

| Do you want to have a single source of truth for your content so you don’t have to manage it in multiple platforms? | ✅ | ✅ |

| Are you looking to maintain or increase the SEO of your websites? | ❌ | ✅ |

| Are you looking to switch to a CMS that will provide cost savings (licensing costs, maintenance costs, developer time and resources)? | ❌ | ✅ |

</div>

CMS Checklist for the Finance Industry

CCPA and/or GDPR Compliance

Financial services are regulated under CCPA and GDPR - the marketing website does need to explicitly state what data is being collected and how it is being used.

What is the difference between GDPR and CCPA, and do you need to be compliant for one, the other, or both? Our CCPA vs GDPR guide offers insight on how these regulations affect your industry.

What many companies are not privy to is that their software may be compromising their CCPA readiness. For instance, plugins on your website that collect data are all weak points that compromise your website’s CCPA compliance. You may be doing everything correctly on your website, but if you’re using a plugin that is found in violation of CCPA, you could be found liable. This is a serious breach not only of governmental regulation but also client trust. Ensuring your website software is CCPA compliant is a major key in 2020 for financial technology companies.

Team Governance

Providing multiple teams and people with access to managing the content on several applications, websites, and platforms may seem like a can of worms that does not need to be opened. FinTechs should make sure their CMS has team governance and roles and permissions for each user, so that they are only provided access to what they need.

For instance, an intern should have write-only permission so they cannot send new content live to the web portal, or a VP of Marketing should have access to read, write, and publish all content - but only read the code of a website or endpoint.

Design Freedom

Design and branding is one of the most important things that can set your company apart - so why be stuck to a template? FinTechs need a CMS that doesn’t lock them into a template and allows for complete design freedom so you can have a functional site without compromising style.

Quick and Easy Landing Page Generation

With an ever-changing landscape, it’s more important now than ever before to ensure your marketing team has agility to change and launch campaigns on the fly, all while collecting analytics and being able to gauge performance.

Is Zesty.io the Right CMS for You?

Zesty.io is an enterprise CMS that was built to solve the omnichannel marketing and development challenges companies in highly regulated industries such as Financial technologies face.

Advantages of Zesty.io for FinTech

SaaS Platform: No need to update, install, patch, or plugin ever again. Changing your content is done by simply logging into the platform.

On Premise or Cloud: Depending on your company’s security requirements, Zesty.io can operate on premise or in our cloud.

99.99% SLAs: our extremely secure platform also guarantees uptime, availability, and global delivery in our SLA.

100% Hosted: not only is our platform hosted, we also host all of your websites and endpoints. With our blazing fast CDN and global availability, clients can access your site in under a second*, no matter where they are.

Developer tools: Our platform offers instant read-only endpoints, customizable endpoints in a number of formats (.HTML, .CSS, .JSON, etc.), and extreme flexibility. Our integration with ATOM means developers can edit locally and push to Zesty.io to accommodate their workflow. Developers can build what they need quickly without sacrificing useability. All endpoints are also protected by a Web Application Firewall (WAF) automatically.

Marketing agility: build templates in Zesty.io to launch campaigns faster, change content no matter where it’s delivered instantly, and preview all changes before they go live in our automatically included staging environment.

SEO Benefits: Automate SEO and easily view meta information and make changes to help boost rankings. Publish content quickly and easily without relying on development teams to publish content for you.

Roles and Permissions: Use Zesty.io’s out of the box roles and permissions or build your own custom to your team. Ensure that team members have the access and permissions they need so that governance is automatically managed.

Workflows: Build in approval workflows with Zesty.io. If something needs to be approved by a content or legal team prior to publish, you can manage that workflow within the system.

Multi Site management: Manage multiple websites for your umbrella of brands under one roof without ever having to update the platform or hosting again. View them all at one glance, share content and images across websites, and more.

Application and Portal Content: Manage content across websites or applications such as iOS and Android apps, web applications, portals, and more. Content managed in Zesty.io can be syndicated anywhere. Once an application is pulling content from Zesty.io, developers don’t need to be involved to make changes again - the marketing team can seize control.

CCPA Compliance: Because Zesty.io is an enterprise SaaS platform, we’ve considered GDPR and CCPA compliance to ensure our customers are also compliant.

* in many cases, websites hosted on and served by Zesty.io experience sub-second page load times.

Is Migrating to Zesty.io Difficult?

With our APIs to ingest content from your platform into ours, migrating can be a breeze. Our team of Solutions Architects will help do a deep dive of your current CMS to help devise the best and most efficient plan for a swift migration. If you need assistance, we also have a vast network of partners across the globe who are ready to help.

Ready to Learn More? Let’s start with an introductory call so we can tailor the perfect demo to your needs.